Article -> Article Details

| Title | India Auto Parts Manufacturing Market Growth and Report by 2033 |

|---|---|

| Category | Automotive --> Automotive Parts |

| Meta Keywords | auto parts mfr |

| Owner | SAKSHI BAHANDARI |

| Description | |

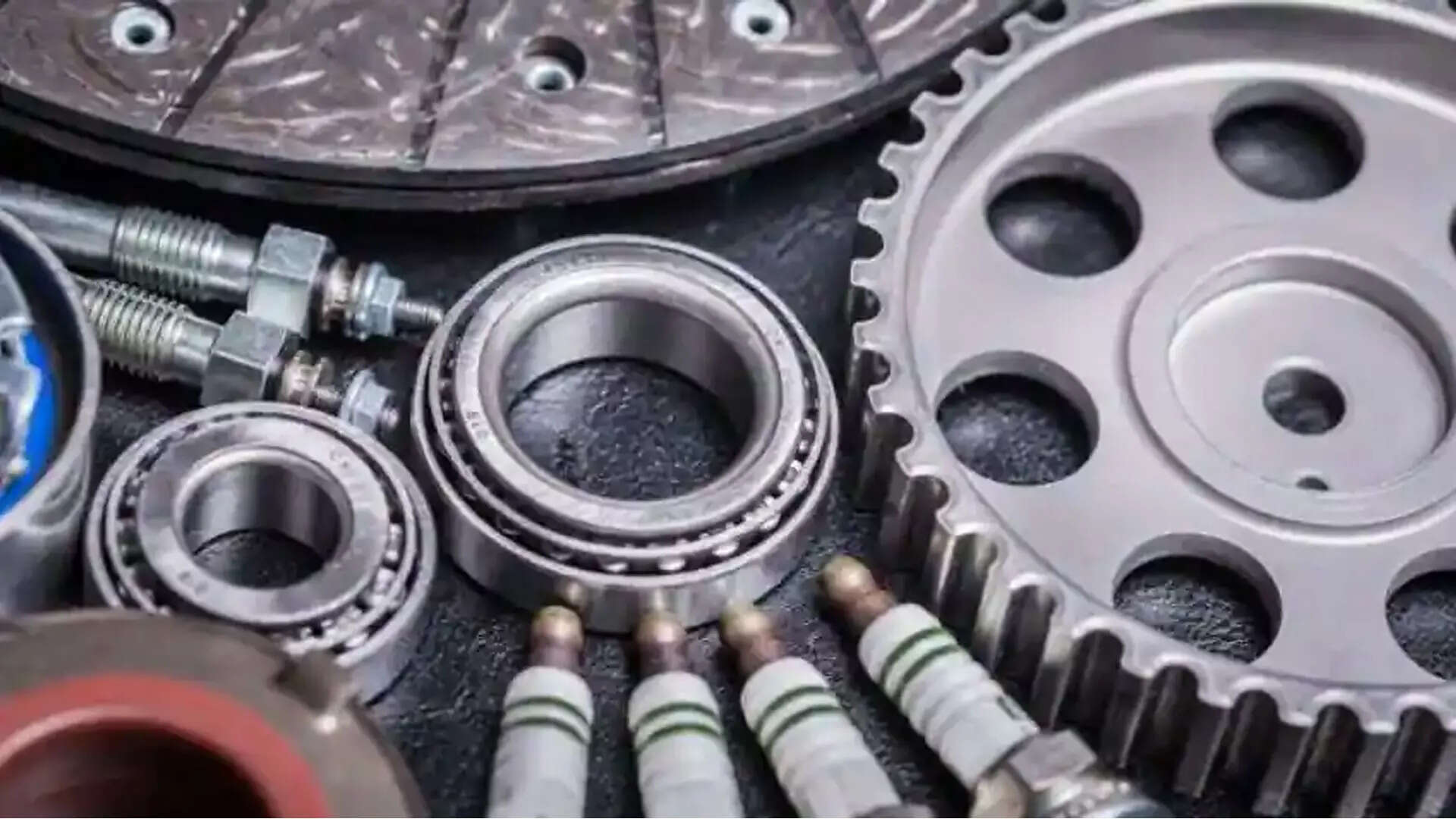

| As indicated in the latest market research report published by IMARC Group, titled "India Auto Parts Manufacturing Market Size, Share, Trends and Forecast by Component Type, Sales Channel, Vehicle Type, and Region, 2025-2033" this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market. the report offers a comprehensive analysis of the industry, including India auto parts manufacturing market growth, share, trends and regional insights. Market Size & Future Growth Potential The India auto parts manufacturing market size reached USD

73.56 Billion in 2024. Looking forward, IMARC Group expects the market to

reach USD 90.58 Billion by 2033, exhibiting a growth rate (CAGR)

of 2.34% during 2025-2033. Recent News and Developments

Latest Market Trends Surging Vehicle Production Accelerating Component Demand Rising vehicle production in India is directly fueling

increased demand for essential automotive components and critical manufacturing

inputs. In September 2024, total production of passenger vehicles,

three-wheelers, two-wheelers, and quadricycles reached 27,73,039 units,

representing significant manufacturing momentum. During April-September FY25,

aggregate production across all vehicle categories reached 1,56,22,388

units, demonstrating sustained industrial capacity expansion and

strengthening demand for braking systems, engines, transmissions, and

sophisticated component assemblies. Automakers are aggressively expanding production capacity to

capture rising demand for personal and commercial vehicles. OEM localization

initiatives are strengthening domestic supply chains and reducing reliance on

imports, positioning India as an increasingly self-sufficient automotive

component manufacturing hub. With the Indian passenger car market projected to

reach USD 54.84 billion by 2027, growing at over 9% annually, sustained demand

for domestically manufactured auto parts and components will continue

accelerating. Electric Vehicle Transition Creating Advanced Component

Opportunities The rapid transition toward electric vehicles is

fundamentally reshaping component demand patterns and creating substantial

opportunities for manufacturers of advanced technology components. The EV

ecosystem is expanding rapidly, with charging station infrastructure projected

to increase from 12,146 stations in February 2024 to 400,000 stations by 2026,

indicating massive investment in EV infrastructure and ecosystem development. As of December 2024, cumulative electric vehicle sales under

the Production Linked Incentive (PLI) scheme reached USD 1.91 billion (₹14,657

crore), demonstrating strong consumer acceptance and production momentum in the

EV segment. Manufacturers are increasingly focusing on localizing advanced EV

components including electric motors, battery management systems, controllers,

and charging systems to reduce imports and enhance export competitiveness.

Accuron Technologies and Hyundai CRADLE have co-invested in Xnergy, a startup

specializing in contactless charging solutions for electric and autonomous

vehicles, exemplifying the innovation ecosystem emerging around EV component

technology. Request Free Sample Report: https://www.imarcgroup.com/india-auto-parts-manufacturing-market/requestsample Market Scope and Growth Factors India's auto parts manufacturing market scope is expanding

substantially as OEMs and aftermarket players increasingly recognize the

strategic importance of domestically sourced, competitively-priced components

in maintaining global competitiveness. The market is characterized by multiple

converging growth catalysts creating favorable conditions for both established

manufacturers and emerging players. Rising Vehicle Ownership and Service Requirements: The

Indian automotive landscape is experiencing rapid vehicle proliferation across

urban and rural regions, directly correlating with increased demand for

maintenance, repairs, and replacement components. Aging vehicle fleets require

frequent servicing, creating sustained demand for brakes, filters, batteries,

electrical components, and underbody assemblies. Increasing urbanization and

improved accessibility are accelerating vehicle usage patterns, necessitating

more frequent component replacement cycles and aftermarket services. Government

regulations emphasizing vehicle safety and emissions standards are encouraging

timely maintenance and component upgrades, further strengthening aftermarket

demand. OEM Capacity Expansion and Localization: Major

automakers including Tata Motors, Mahindra & Mahindra, and Hyundai are

significantly investing in production capacity expansion, particularly for

electric vehicles. Hyundai pledged additional investments of USD 743

million (₹6,180 crore) for long-term manufacturing expansion in Tamil

Nadu during the 2024 global investor meet. These capacity expansions directly

translate to increased demand for localized component supplies from domestic

manufacturers, creating growth opportunities across the supplier ecosystem. Explore the Full Report: https://www.imarcgroup.com/india-auto-parts-manufacturing-market Market Segmentation Analysis Segmentation by Component Type:

Segmentation by Sales Channel:

Segmentation by Vehicle Type:

Segmentation by Region:

Discuss Your Needs with Our Analyst – Get Customized

Report Now: https://www.imarcgroup.com/request?type=report&id=29646&flag=C Competitive Landscape The report offers an in-depth examination of the competitive

landscape. It includes thorough competitive analysis encompassing market

structure, key player positioning, leading strategies for success, a

competitive dashboard, and a company evaluation quadrant with detailed profiles

of all major companies. About IMARC Group IMARC Group is a leading market research company that offers

management strategy and market research services worldwide. We partner with

clients in all sectors and regions to identify their highest-value opportunities,

address their most critical challenges, and transform their businesses through

data-driven insights and strategic analysis. IMARC's information products encompass major market,

scientific, economic, and technological developments for business leaders in

pharmaceutical, industrial, and high-technology organizations. Our expertise

spans comprehensive market forecasts and industry analysis across

biotechnology, advanced materials, pharmaceuticals, food and beverage, travel

and tourism, nanotechnology, and novel processing methods. Contact Information IMARC Group 134 N 4th St. Brooklyn, NY 11249,

USA Email: Sales@imarcgroup.com Phone:

| |