Article -> Article Details

| Title | India Generator Market Share Analysis and Growth Outlook 2025-2033 | Get Sample Report |

|---|---|

| Category | Automotive --> Automotive Parts |

| Meta Keywords | India Generator Market |

| Owner | SAKSHI BAHANDARI |

| Description | |

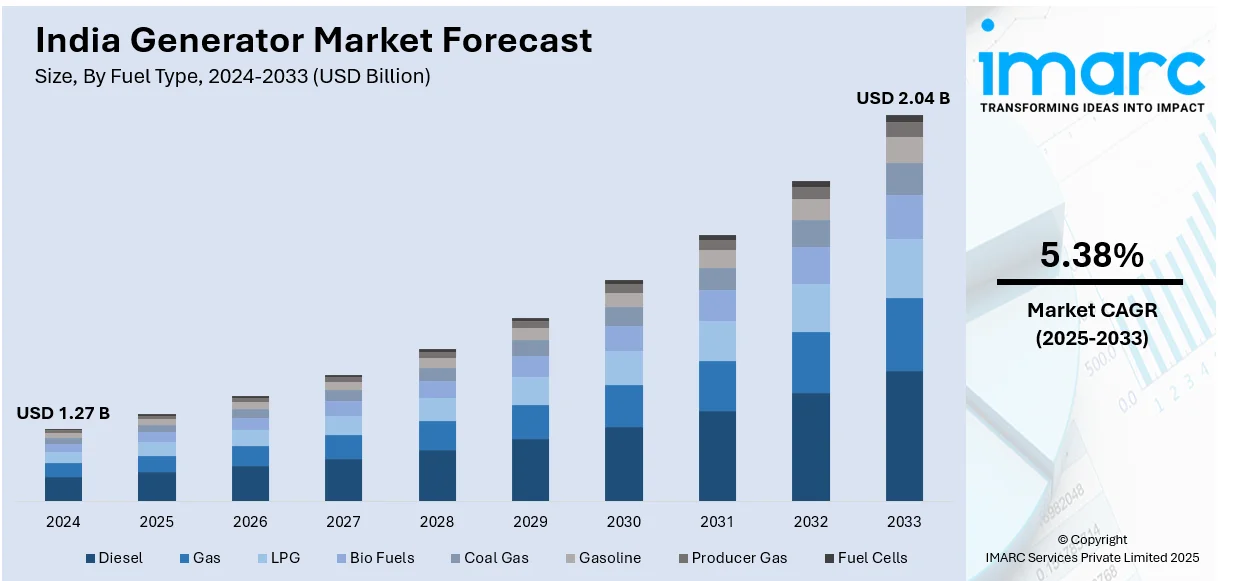

| According to IMARC Group’s latest report titled "India Generator Market share, size, Trends and Forecast by Fuel Type, Power Rating, Sales Channel, Design, Application, End User, and Region, 2025-2033", this study offers a granular analysis of the country's backup power landscape. The study offers a profound analysis of the industry, encompassing India generator market research report, share, size, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the impact of strict CPCB IV+ emission norms, the rising adoption of gas and hybrid generators, and the sustained demand from the infrastructure and data center sectors.

Market At-A-Glance: Key Statistics (2025-2033):

Note: We are in the process of updating our reports to cover the 2026–2034 forecast period. For the most recent data, market insights, and industry updates, please click on ‘Request Free Sample Report’. Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-generator-market/requestsample India Generator Market Overview The India generator market size reached USD 1.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.04 Billion by 2033, exhibiting a steady growth rate (CAGR) of 5.38% during 2025-2033. The market is witnessing a structural shift, primarily driven by the implementation of stringent environmental regulations like CPCB IV+, which mandate significantly lower emission levels for diesel gensets. This has catalyzed the demand for cleaner alternatives such as gas-based and hybrid generators. Rapid urbanization, coupled with the expansion of commercial infrastructure—particularly data centers, hospitals, and IT parks—continues to necessitate reliable backup power solutions to mitigate grid instability. Furthermore, the "Make in India" initiative and robust industrial growth in sectors like manufacturing and construction are sustaining the demand for high-capacity generators. Top Emerging Trends in the India Generator Market:

India Generator Market Growth Factors (Drivers)

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-generator-market Market Segmentation Analysis by Fuel Type:

Analysis by Power Rating:

Analysis by Sales Channel:

Analysis by Design:

Analysis by Application:

Analysis by End User:

Regional Insights:

India Generator Market Recent Developments & News

Why Buy This Report? (High-Value Insights)

Key Highlights of the Report

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=29872&flag=E Customization Note: If you require specific data we can provide it as part of our customization services. About Us: IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research. Contact Us: IMARC Group 134 N 4th St. Brooklyn, NY 11249, USA Email: sales@imarcgroup.com Tel No:(D) +91 120 433 0800 United States: +1-201971-6302 | |