Article -> Article Details

| Title | India Herbal Tea Market Outlook & Trends Forecast by 2034 |

|---|---|

| Category | Business --> Food and Related |

| Meta Keywords | india herbal tea market |

| Owner | SAKSHI BAHANDARI |

| Description | |

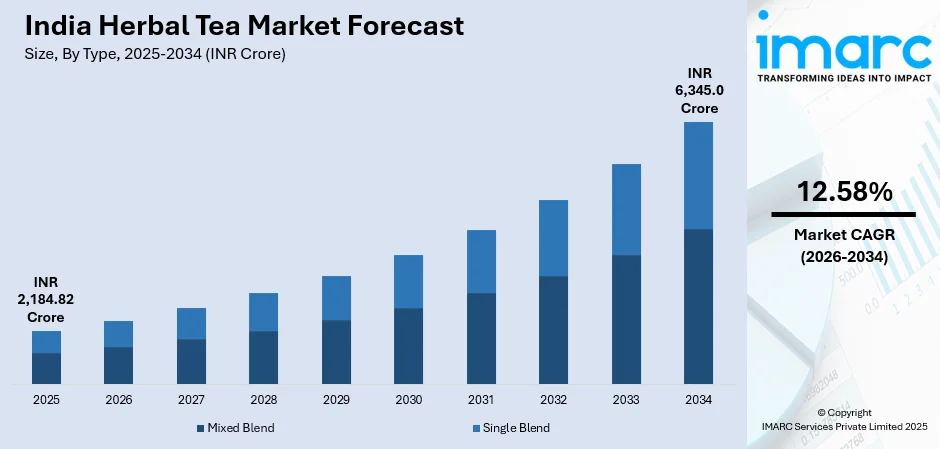

| The India herbal tea market size was valued at INR 2,184.82 Crore in 2025 and is projected to reach INR 6,345.0 Crore by 2034, growing at a compound annual growth rate (CAGR) of 12.58% from 2026 to 2034. Demand is driven by increasing consumer health awareness and wellness attributes of herbal teas. Innovations in flavor, packaging convenience, and expansive distribution networks boost growth especially in urban and semi-urban markets. The report presents a thorough review featuring the India herbal tea market outlook, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

INDIA HERBAL TEA MARKET KEY TAKEAWAYS

Sample Request Link: https://www.imarcgroup.com/india-herbal-tea-market/requestsample MARKET TRENDS Indian consumers show a rising preference for functional and immunity-boosting herbal tea blends, with brands like Chull Wali Chai launching herbal variants targeted at relaxation, mental clarity, and vitality in 2025. These blends incorporate adaptogenic, immunity-supporting, and stress-relieving botanicals, aligning with preventive wellness and natural remedy trends. Vibrant packaging appeals strongly to younger, health-focused demographics. Premiumization and artisanal offerings are shaping the market with consumers willing to pay higher prices for single-origin, organic, and traditional Ayurvedic teas. Wellness brand Heiland’s loose-leaf blends supporting immunity, digestion, and relaxation illustrate consumer interest. Sustainable and gift-worthy packaging enhance perceived value among urban affluent buyers. E-commerce and direct-to-consumer channels are gaining importance, with the Indian e-commerce market valued at USD 129.72 billion in 2025 and projected to reach USD 651.10 billion by 2034. These digital platforms broaden access to specialty herbal teas and improve consumer education, facilitating personalized marketing and subscription models that strengthen brand loyalty. MARKET GROWTH FACTORS Growth is driven by rising health consciousness and wellness lifestyle adoption across India. Consumers increasingly prioritize preventive healthcare and natural wellness products such as herbal infusions that offer antioxidant, digestive, and immune benefits. Active incorporation of herbal teas into daily self-care routines underscores the market’s sustained adoption. Consumer interest in caffeine-free and natural beverage alternatives accelerates demand. Startups and beverage makers promote caffeine-free herbal drinks using locally sourced botanicals, addressing concerns over caffeine and artificial additives. Quality herbal teas appeal for all-day consumption without stimulant effects and meet demand for clean-label beverages free of added sugars and synthetic flavors. The expansion of organized retail and e-commerce greatly improves accessibility. Tier-II and Tier-III cities now represent over 60% of e-commerce transactions, connecting specialty herbal teas beyond metro areas. An omnichannel approach, including in-store and digital experiences with personalized recommendations, supports diverse consumer preferences and fosters market penetration. MARKET SEGMENTATION Type:

Mixed blend herbal teas, combining multiple botanicals, offer complex flavors and wellness benefits. Products such as House of Veda’s variants target immunity, digestion, memory, and stress relief, reflecting demand for comprehensive wellness solutions. Pack Type:

Pouches dominate due to economic viability, lightweight nature, resealability, and freshness preservation. Innovations include stand-up designs, zip-lock closures, and multilayer barrier materials. Eco-friendly pouches are increasingly adopted among urban consumers. Pack Size:

The 250 grams pack size leads, balancing value for money and freshness, fulfilling daily consumption needs. It is preferred by frequent shoppers for variety testing without heavy upfront costs and is attractive to retailers for profitability. Distribution Channel:

Supermarkets and hypermarkets lead distribution, offering broad product lines, competitive pricing, and convenient retailing. Health drink sections and modern shopping infrastructure increase visibility and market penetration. Region:

REGIONAL INSIGHTS North India holds the dominant market position with a 30% share in 2025. This is driven by its strong agricultural base for cultivating high-quality herbs, established supply chains, and heightened consumer health awareness. Urbanization, e-commerce growth, and innovations with local botanicals like tulsi and ashwagandha reinforce North India as the leading herbal tea hub. RECENT DEVELOPMENTS & NEWS In March 2025, Hindustan Unilever Ltd. launched UK-based herbal infusions brand Pukka in India with the wellness campaign "Self Care in a Cup." The campaign features an ASMR-inspired film promoting relaxation through herbal blends such as chamomile and lavender. This launch marks Unilever’s entry into the Indian herbal tea market, highlighting an increased focus on wellness-oriented beverage options. KEY PLAYERS

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization. ABOUT US IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research. CONTACT US IMARC Group, 134 N 4th St. Brooklyn, NY 11249, USA, Email: sales@imarcgroup.com, Tel No: (D) +91-120-433-0800, United States: +1-201-971-6302 | |