Article -> Article Details

| Title | India Material Handling Equipment Market Outlook, Growth & Demand Forecast 2026-2034 |

|---|---|

| Category | Business --> Services |

| Meta Keywords | India Material Handling Equipment Market |

| Owner | SAKSHI BAHANDARI |

| Description | |

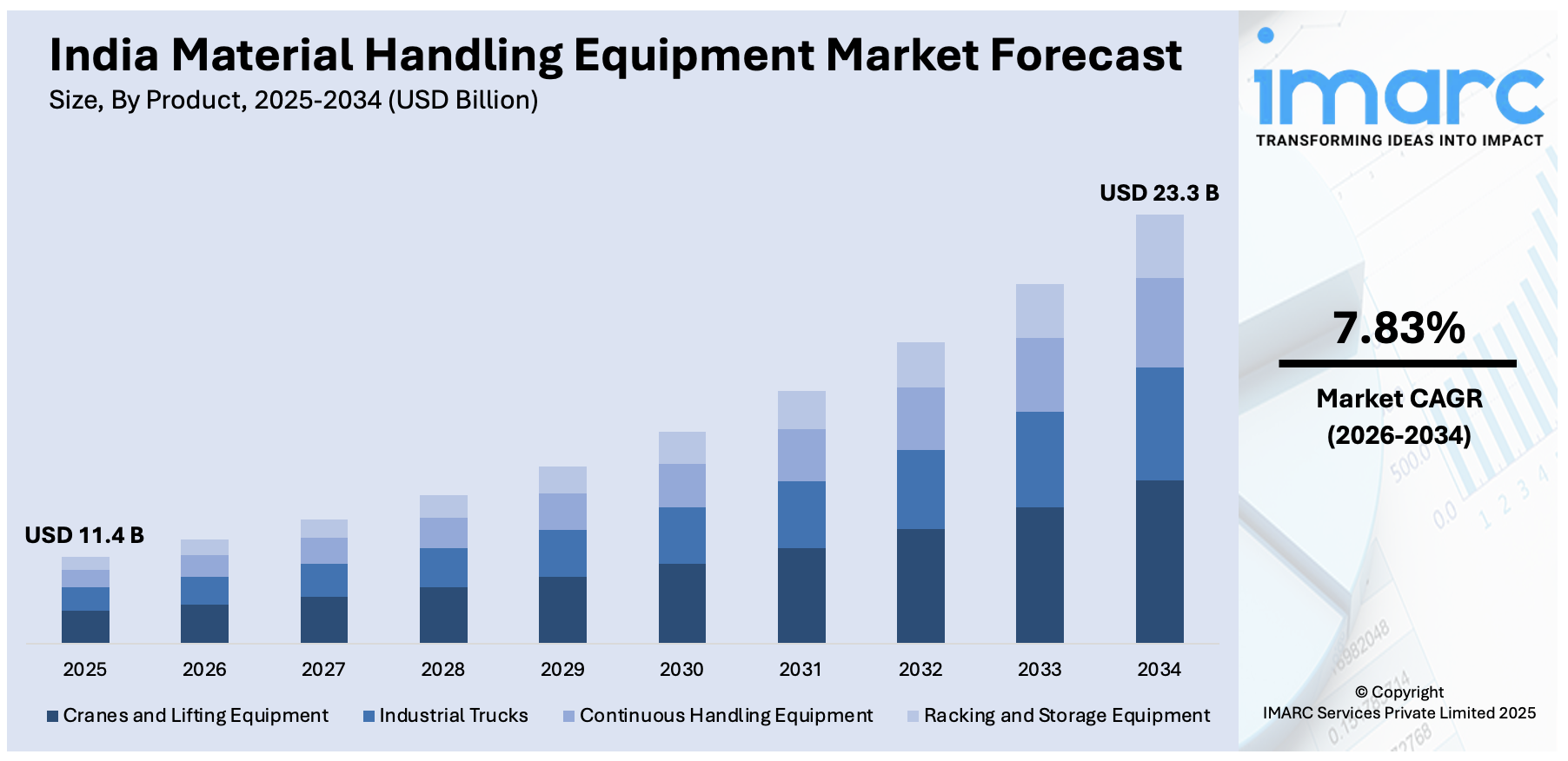

| The India material handling equipment market size reached USD 11.4 Billion in 2025 and is expected to reach USD 23.3 Billion by 2034, growing at a CAGR of 7.83% during 2026-2034. This growth is driven by rapid industrialization, expanding manufacturing activities, government initiatives like the Production-Linked Incentive (PLI) scheme, rising e-commerce logistics, and increasing infrastructure development. These factors contribute to higher demand for advanced automation, efficient warehousing solutions, and technologically upgraded handling systems across industries.The report presents a thorough review featuring the India material handling equipment market outlook, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

INDIA MATERIAL HANDLING EQUIPMENT MARKET KEY TAKEAWAYS

Sample Request Link: https://www.imarcgroup.com/india-material-handling-equipment-market/requestsample MARKET TRENDS The manufacturing sector in India is the backbone of the economy, significantly impacting material handling equipment demand. The Annual Survey of Industries (ASI) 2021-22 reported a 26.6% surge in Gross Value Added (GVA) in manufacturing, reflecting a strong post-pandemic recovery. Key manufacturing industries, including basic metals, refined petroleum, pharmaceuticals, automobiles, food products, and chemicals, contributed approximately 56% of the total GVA. This increase in production necessitates effective handling solutions to manage high production volumes efficiently, fueling market growth. Infrastructure development and government support through initiatives like production-linked incentives (PLI) are pivotal in market growth. Significant investments in transportation, logistics, and manufacturing infrastructure create high demand for material handling equipment. The capital goods industry benefits from PLI schemes in automobiles and electric vehicles, indirectly boosting capital goods demand. Industries contributing 85% of India's capital goods export include heavy electrical and power equipment, earthmoving and mining equipment, and process plant equipment. The positive trajectory of the Index of Industrial Production (IIP) indicates rising industrial activity, translating to greater demand for handling equipment. The integration of digital transformation and smart automation is reshaping the industry. Technologies such as IoT sensors, artificial intelligence (AI), and machine learning (ML) allow companies to monitor equipment performance in real time, enabling predictive maintenance and data-driven decision-making. Such automation enhances productivity and reduces downtime, while internet-of-things-enabled warehouses optimize logistics processes. AI analytics offer insights into inventory, demand forecasting, and energy consumption. Driven by expanding e-commerce, automotive, and manufacturing sectors, these innovations are crucial for India's Industry 4.0 journey towards scalability and operational excellence. MARKET GROWTH FACTORS The rapid expansion of India's manufacturing sector, supported by government initiatives like the Production-Linked Incentive (PLI) scheme, drives considerable demand for advanced material handling equipment. Increased manufacturing activities across industries such as basic metals, pharmaceuticals, and automobiles require cutting-edge equipment to enhance operational efficiency and competitiveness. Innovation investment among manufacturers is critical for improving productivity, as evidenced by the National Manufacturing Innovation Survey (NMIS) 2021-22, which highlights the role of advanced handling systems in boosting output. Rising e-commerce activities and growing infrastructure projects across India offer substantial growth opportunities. The development and modernization of logistics and manufacturing facilities necessitate efficient material handling solutions to manage the movement and storage of goods effectively. Government focus on strong infrastructure formation fosters demand for equipment supporting construction and operational phases. Production-linked incentive programs promote manufacturing excellence and expansion, further augmenting equipment requirements. Sustainability and energy-efficient solutions increasingly influence market growth. Firms shift toward electric-powered forklifts, pallet trucks, and automated guide vehicles (AGVs) to reduce carbon footprints in response to environmental concerns and regulatory demands. Warehousing facilities adopt alternative energy sources such as solar charging stations and pursue green building certifications. Battery technology improvements, such as lithium-ion advancements, enhance energy efficiency and longevity, facilitating corporate sustainability initiatives that align operational performance with environmental responsibilities. MARKET SEGMENTATION Product Insights:

Application Insights:

REGIONAL INSIGHTS The report segments the market into North India, South India, East India, and West India. Specific statistics such as regional market shares or CAGR per region are not detailed in the source. The comprehensive analysis of these major regional markets contributes to understanding the market’s geographic distribution and growth potential. Summary: The India material handling equipment market is analyzed across North, South, East, and West India, providing insights into regional demand patterns and market dynamics. Exact regional market shares or CAGR figures are not provided in the source. RECENT DEVELOPMENTS & NEWS

KEY PLAYERS

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization. ABOUT US IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research. CONTACT US IMARC Group, 134 N 4th St. Brooklyn, NY 11249, USA, Email: sales@imarcgroup.com, Tel No: (D) +91-120-433-0800, United States: +1-201-971-6302 | |