Article -> Article Details

| Title | India Packaged Jaggery Market Trends, Growth & Demand Forecast 2026-2034 |

|---|---|

| Category | Business --> Services |

| Meta Keywords | India Packaged Jaggery Market |

| Owner | SAKSHI BAHANDARI |

| Description | |

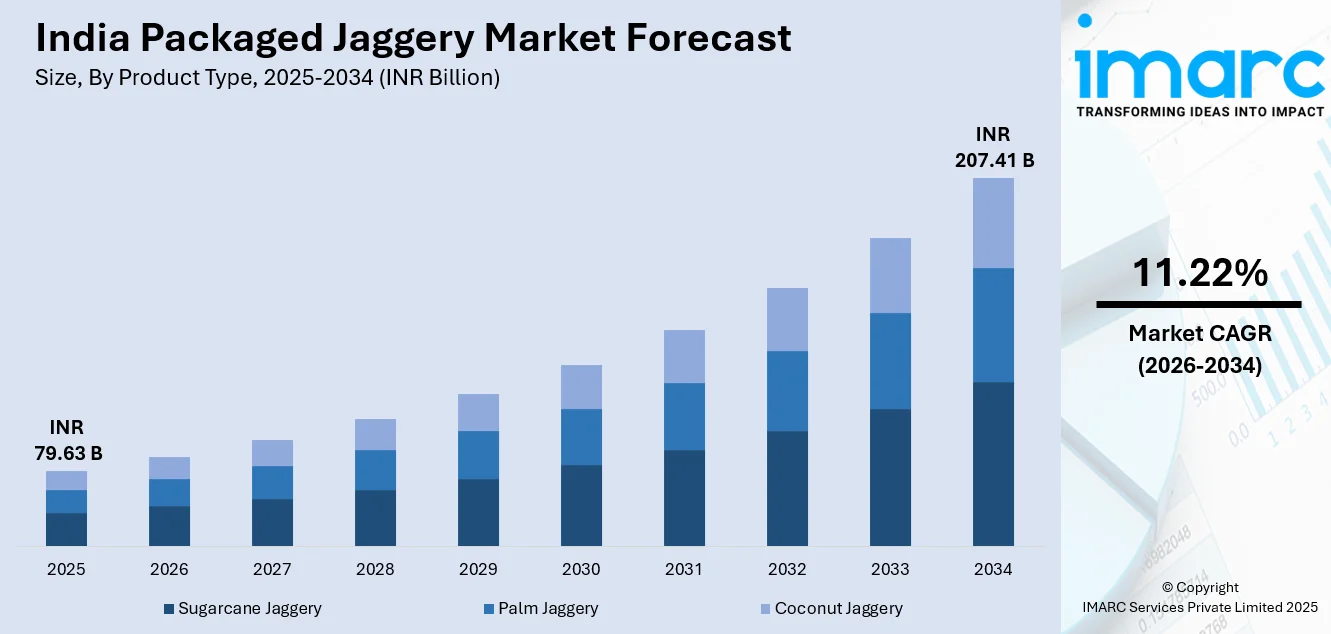

| The India packaged jaggery market was valued at INR 79.63 Billion in 2025 and is forecast to reach INR 207.41 Billion by 2034. The market is expected to grow at a CAGR of 11.22% during the forecast period 2026-2034. This robust growth is driven by increased health awareness, urbanization, evolving dietary preferences, and expansion of modern retail and e-commerce channels, which improve accessibility to hygienic, natural sweetener products. The report presents a thorough review featuring the India packaged jaggery market trends, share, trends, and research of the industry.

STUDY ASSUMPTION YEARS

INDIA PACKAGED JAGGERY MARKET KEY TAKEAWAYS

Sample Request Link: https://www.imarcgroup.com/india-packaged-jaggery-market/requestsample MARKET TRENDS Consumers are increasingly preferring organic and clean-label jaggery products that guarantee chemical-free production and transparent sourcing. Organic certifications like India Organic and USDA Organic enable access to premium segments. This shift aligns with the wellness trend emphasizing minimally processed foods and additive-free products that preserve traditional nutritional profiles and meet stringent hygiene standards. The growth of e-commerce and direct-to-consumer distribution is revolutionizing packaged jaggery sales by connecting producers directly with health-conscious urban consumers. Online platforms provide extensive product variety with detailed ingredient information and convenient doorstep delivery, appealing particularly to younger demographics. This transformation allows smaller producers nationwide market access and consumer authentication via reviews and certifications. Innovation in jaggery product formats is expanding beyond traditional blocks to powders, granules, cubes, and liquid forms supporting various culinary uses. Food manufacturers increasingly use jaggery as a natural sweetener in snacks, confectioneries, beverages, and supplements. Value-added variants infused with spices or herbs cater to wellness-focused consumers, broadening jaggery’s appeal to contemporary dietary preferences. MARKET GROWTH FACTORS Increasing health consciousness amidst rising lifestyle diseases such as diabetes and obesity is reshaping consumer sweetener choices. Packaged jaggery, rich in minerals like iron and potassium, is recognized as a nutritious substitute for refined sugar. Ayurvedic associations with digestive health and immunity reinforce its appeal. Healthcare professionals recommend jaggery especially for individuals managing blood sugar, driving market growth. The expansion of modern retail infrastructure, including supermarkets and specialty organic stores, enhances packaged jaggery’s presence on dedicated shelves, elevating it to a premium product. Concurrently, the rapid growth of e-commerce and quick commerce democratizes access to premium jaggery products beyond geographic barriers. Online platforms provide nutritional information and customer reviews, supporting informed purchases and amplifying reach. Government regulatory support via the Food Safety and Standards Authority of India (FSSAI) enforces quality standards for jaggery including permissible moisture content and labeling transparency. This strengthens consumer confidence and industry professionalism, differentiating compliant manufacturers from unorganized producers. Traceability and certification facilitate premium positioning and protect consumers from adulterated products, stimulating market expansion. MARKET SEGMENTATION Product Type

Pack Type

Pack Size

Region

REGIONAL INSIGHTS North India leads the packaged jaggery market with a 30% share in 2025, backed by Uttar Pradesh’s dominant sugarcane cultivation and jaggery production infrastructure. Fertile agricultural conditions and robust supply chains foster competitive pricing. Cultural traditions embed jaggery in everyday cuisine and festivities, with government initiatives boosting production modernization and market premiumization. RECENT DEVELOPMENTS & NEWS Not provided in source. KEY PLAYERS

Customization Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization. ABOUT US IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research. CONTACT US IMARC Group, 134 N 4th St. Brooklyn, NY 11249, USA, Email: sales@imarcgroup.com, Tel No: (D) +91-120-433-0800, United States: +1-201-971-6302 | |