Article -> Article Details

| Title | Intent-Based Protocols in DeFi: The Future of AI Trading |

|---|---|

| Category | Business --> Internets |

| Meta Keywords | Intent-Based Protocols in DeFi, The Future of AI Trading |

| Owner | Aman |

| Description | |

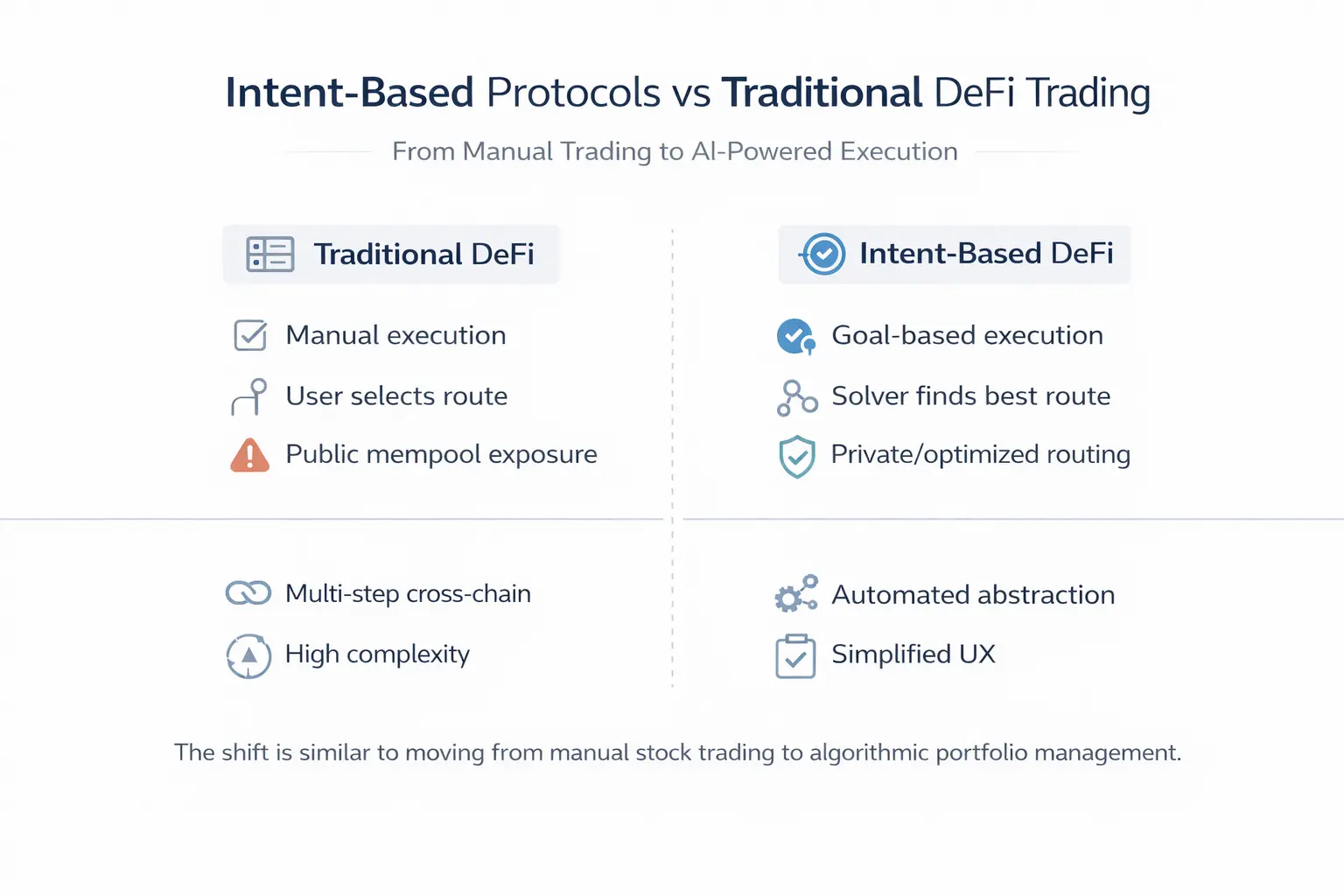

| Decentralized finance has evolved rapidly over the last few years. From simple token swaps to complex yield strategies, DeFi has unlocked unprecedented financial freedom. Yet one major limitation remains manual execution. Users must still decide which DEX to use, calculate slippage, compare liquidity pools, manage gas fees, and avoid MEV risks. This complexity creates friction and inefficiency. This is where Intent-Based Protocols in DeFi are changing the game. Instead of manually executing transactions, users simply declare their goal and intelligent systems handle the rest.

What Are Intent-Based Protocols in DeFi?Intent-based protocols represent a shift from imperative execution to declarative outcomes. In traditional DeFi:

In an intent-based system: You simply state your goal. For example:

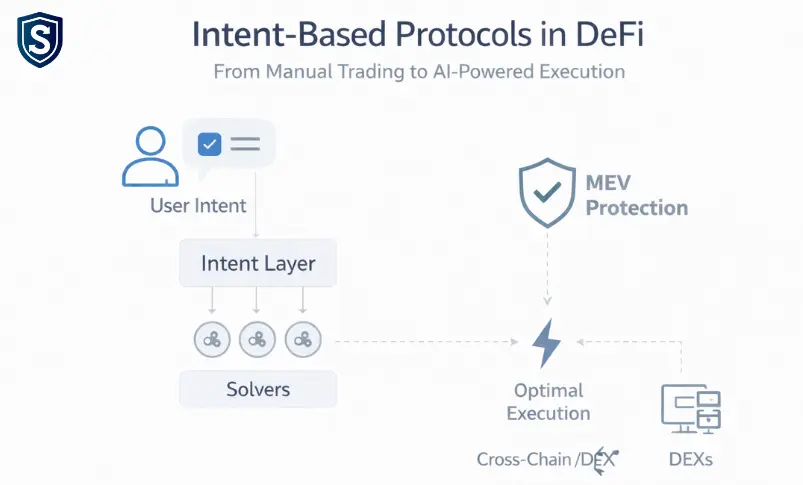

The system then finds the most efficient way to fulfill that intent. This abstraction layer is what makes intent-based DeFi so powerful. How Intent-Based Protocols WorkAt the core of these systems are specialized actors known as solvers (or fillers). 1. User Declares an IntentThe user submits a high-level objective instead of a transaction path. 2. Solvers CompeteIndependent third-party solvers analyze the intent and compete to execute it in the most optimal way. They search across:

The solver offering the best execution fulfills the transaction. 3. SettlementThe transaction is executed and settled on-chain once the best route is determined. This competitive model ensures:

The Role of AI in Intent-Based DeFiAI significantly enhances the capabilities of intent-based protocols. 1. Natural Language Processing (NLP)Instead of technical inputs, users could simply type: “Move my funds to the safest yield strategy with stable returns.” AI interprets this intent and converts it into executable parameters. 2. Predictive Trade OptimizationAI can:

This allows the system to dynamically choose the best execution strategy. 3. Autonomous Strategy ExecutionIn the future, AI agents may continuously:

This moves DeFi from manual trading toward fully autonomous finance. Key Benefits of Intent-Based Protocols in DeFi1. Improved EfficiencySolvers search across fragmented liquidity sources to find the optimal execution route. This results in:

Instead of users manually comparing platforms, the protocol handles optimization automatically. 2. MEV ProtectionMaximal Extractable Value (MEV) is a major problem in DeFi. Public mempool transactions can be front-run or sandwiched. Intent-based protocols reduce this risk by:

This significantly improves trade security. 3. Gas Optimization & Gasless TradingSolvers can internalize gas fees into execution pricing. In some designs:

This simplifies onboarding and improves accessibility. 4. Simplified User Experience (UX)One of DeFi’s biggest barriers is complexity. Intent-based systems reduce:

The result is a smoother and more intuitive trading experience. Intent-Based Protocols vs Traditional DeFi Trading | |